Navigating Financial Excellence. Empowering Transformation through Innovative Solutions

Unveiling the Future of Financial Operations: Harnessing the Power of Cutting-Edge IT Technologies for Enhanced Efficiency and Strategic Growth.

Benefits for Financial companies

Discover a Spectrum of Challenges We Tackle and the Invaluable Benefits We Bring to the Healthcare Sector.

-

Digital Banking and Customer Experience Enhancement

Digital Banking and Customer Experience EnhancementDelivering seamless and personalized digital banking experiences while safeguarding data privacy is a pressing challenge. Chiron crafts intuitive digital banking solutions that enhance customer experiences, allowing users to securely manage accounts, conduct transactions, and access financial services on any device.

-

Fraud Detection and Prevention

Fraud Detection and PreventionFinancial institutions face increasing cyber threats and fraudulent activities that can result in financial losses and reputational damage. Chiron employs advanced AI and machine learning algorithms to detect and prevent fraud in real time, safeguarding transactions and ensuring a secure financial ecosystem.

-

Risk Management and Regulatory Compliance

Risk Management and Regulatory ComplianceAdhering to complex regulatory frameworks and managing financial risk is a critical concern for institutions. Chiron's risk management and compliance solutions employ advanced analytics and automation to assess and mitigate risks, ensuring adherence to regulations and safeguarding financial stability.

-

Robotic Process Automation (RPA) for Financial Operations

Robotic Process Automation (RPA) for Financial OperationsManual and repetitive financial processes hinder efficiency and increase the likelihood of errors. Chiron deploys RPA technologies to automate routine financial tasks, reducing errors, improving operational speed, and freeing up human resources for strategic initiatives.

Check out related Case Studies

-

HighlightsLEARN MORE

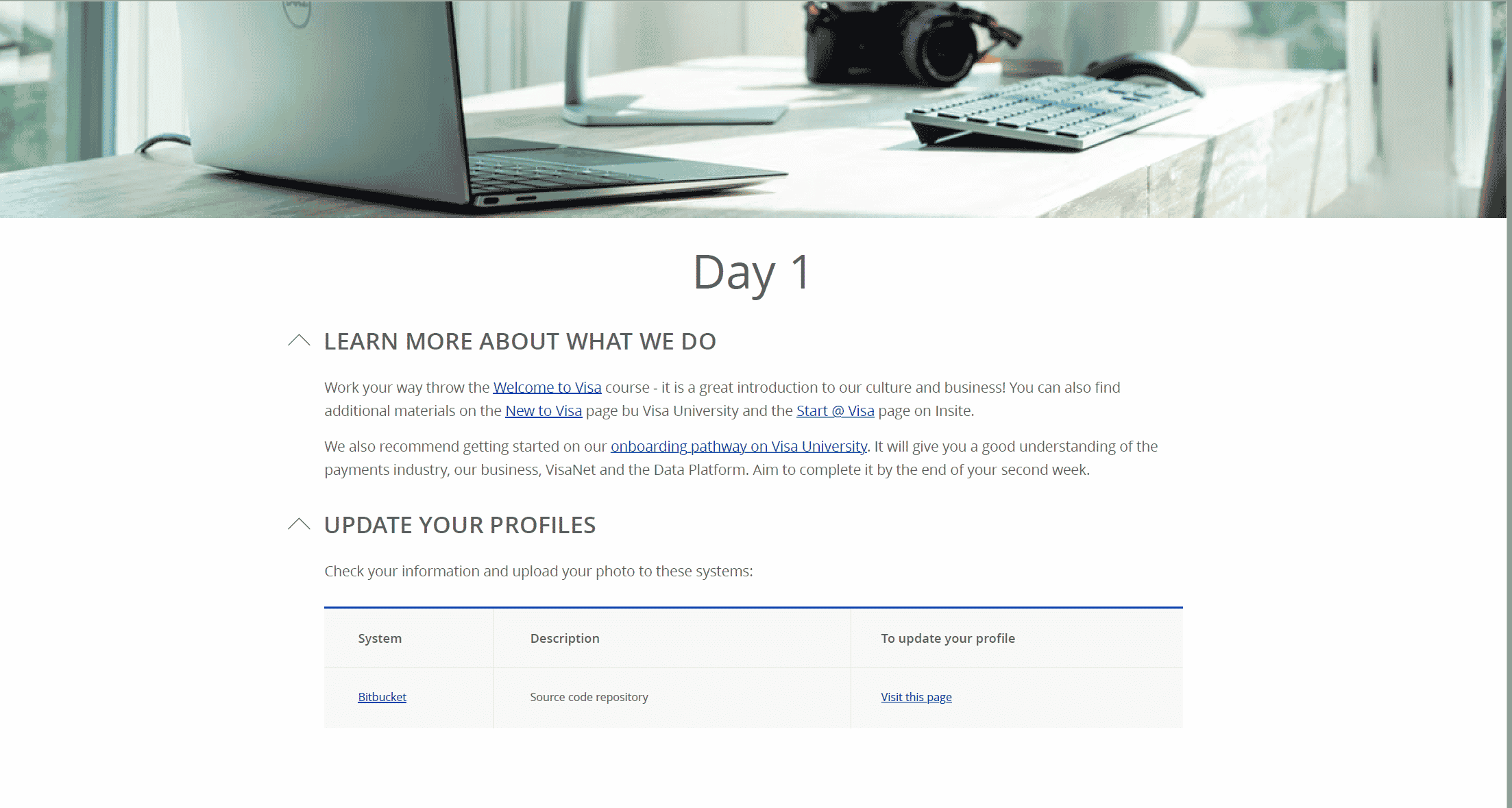

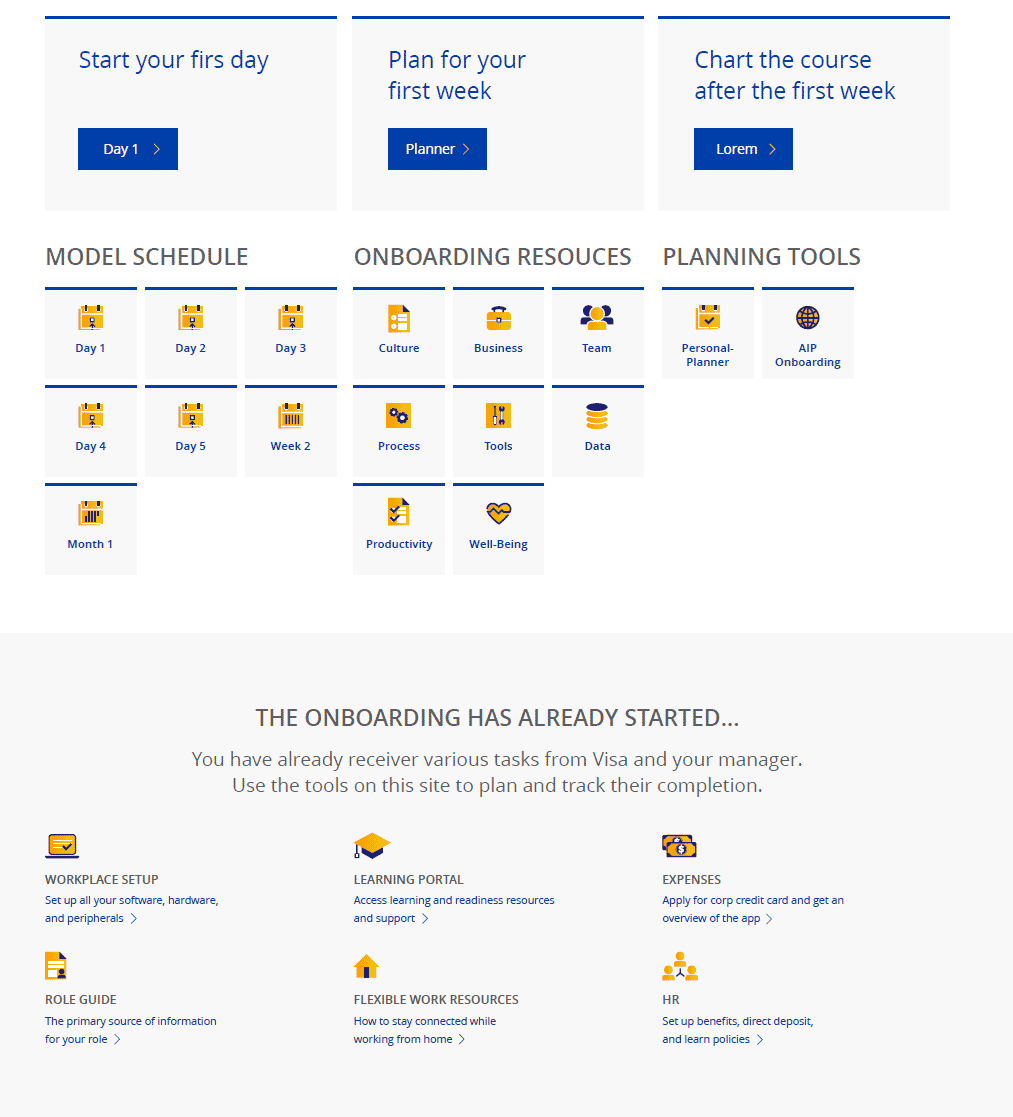

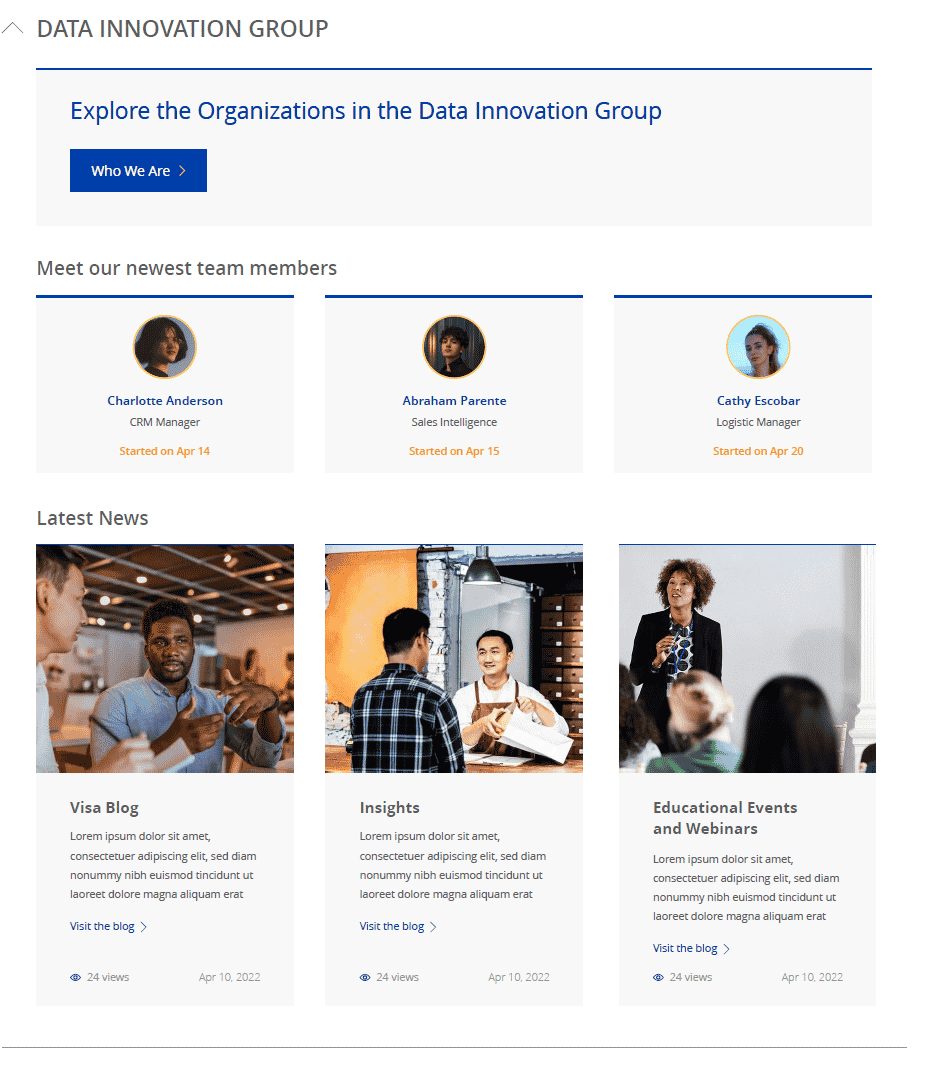

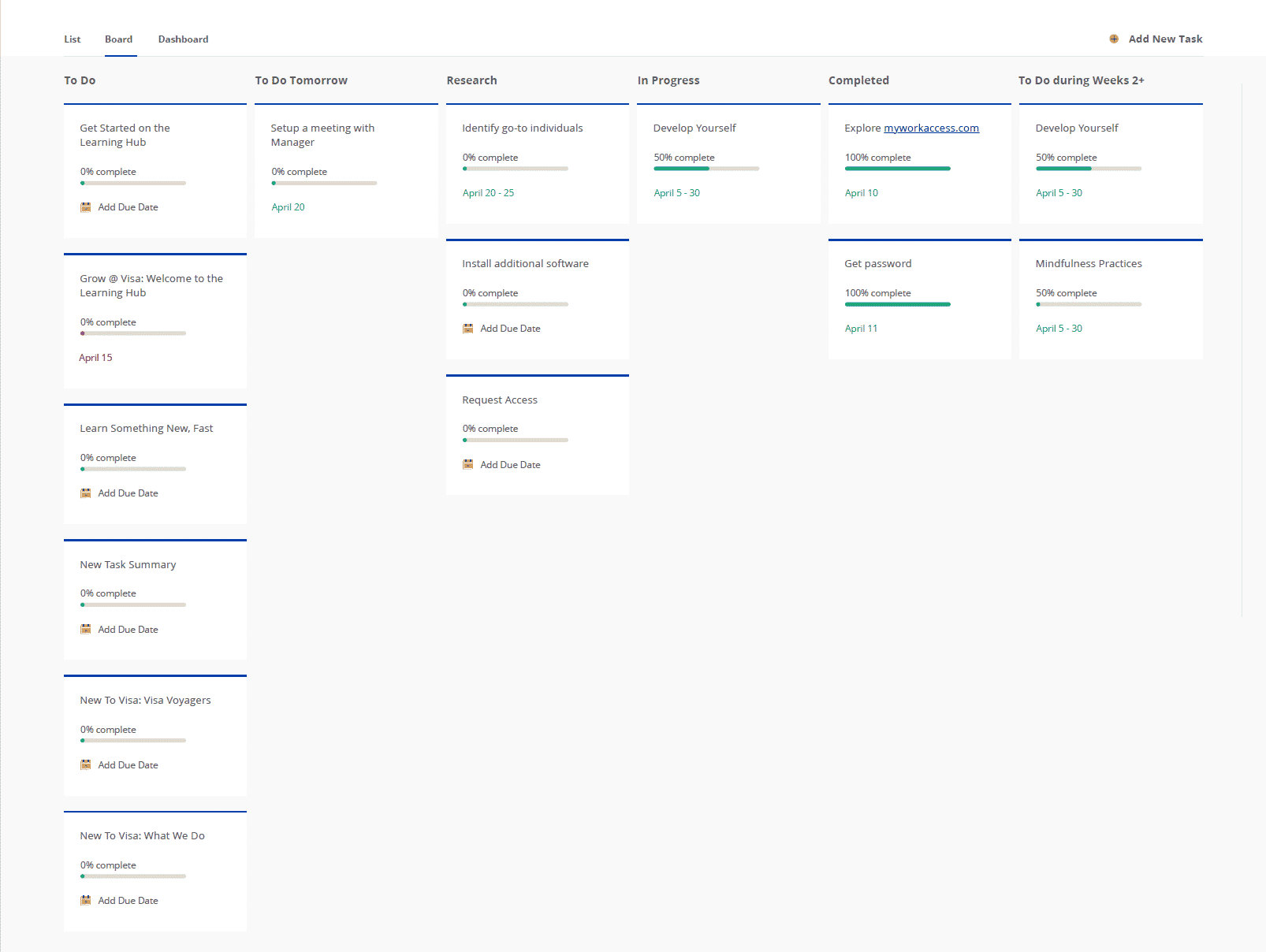

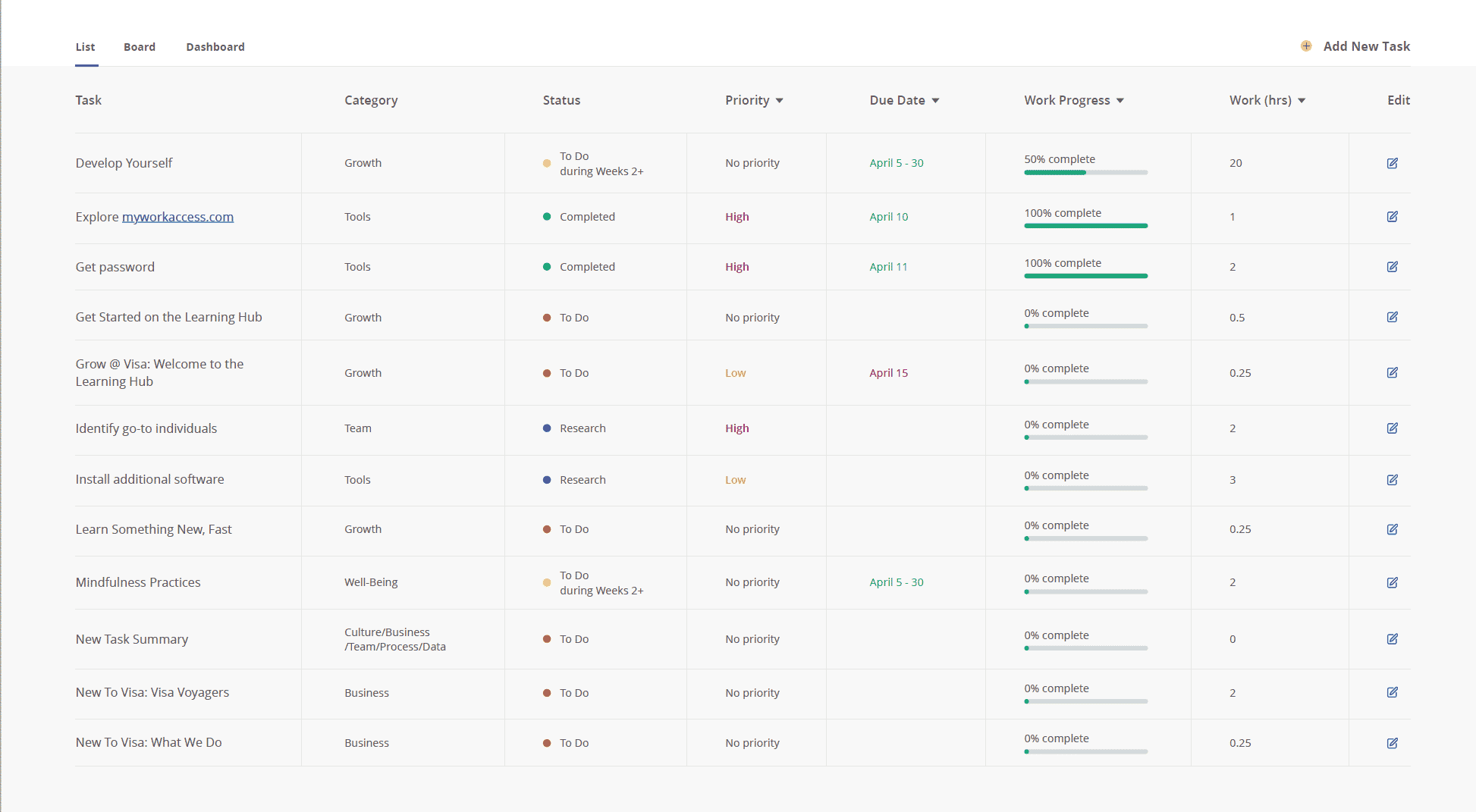

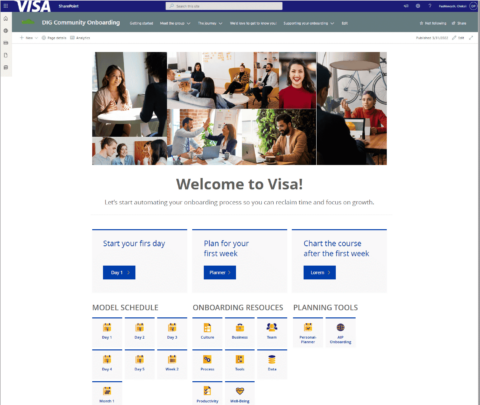

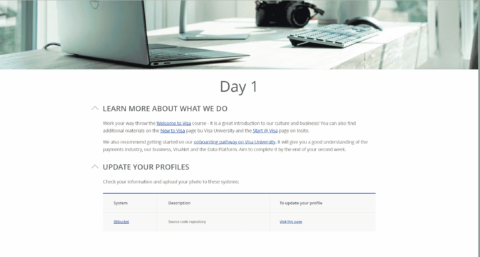

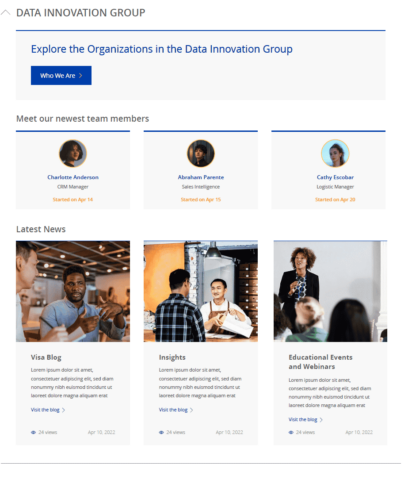

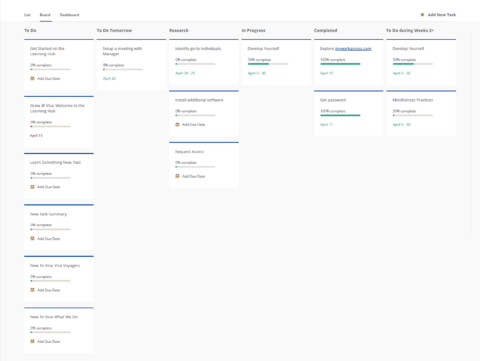

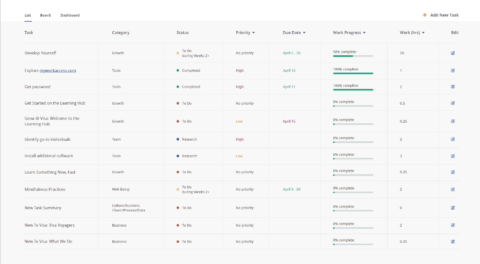

HighlightsLEARN MOREChiron served as a key implementation partner for Visa’s Data Science department, providing support and expertise to address their specific needs. As a trusted partner, Chiron collaborated with Visa’s USA West Coast headquarters to deliver effective solutions that aligned with their goals and requirements.

LEARN MORE -

HighlightsLEARN MORE

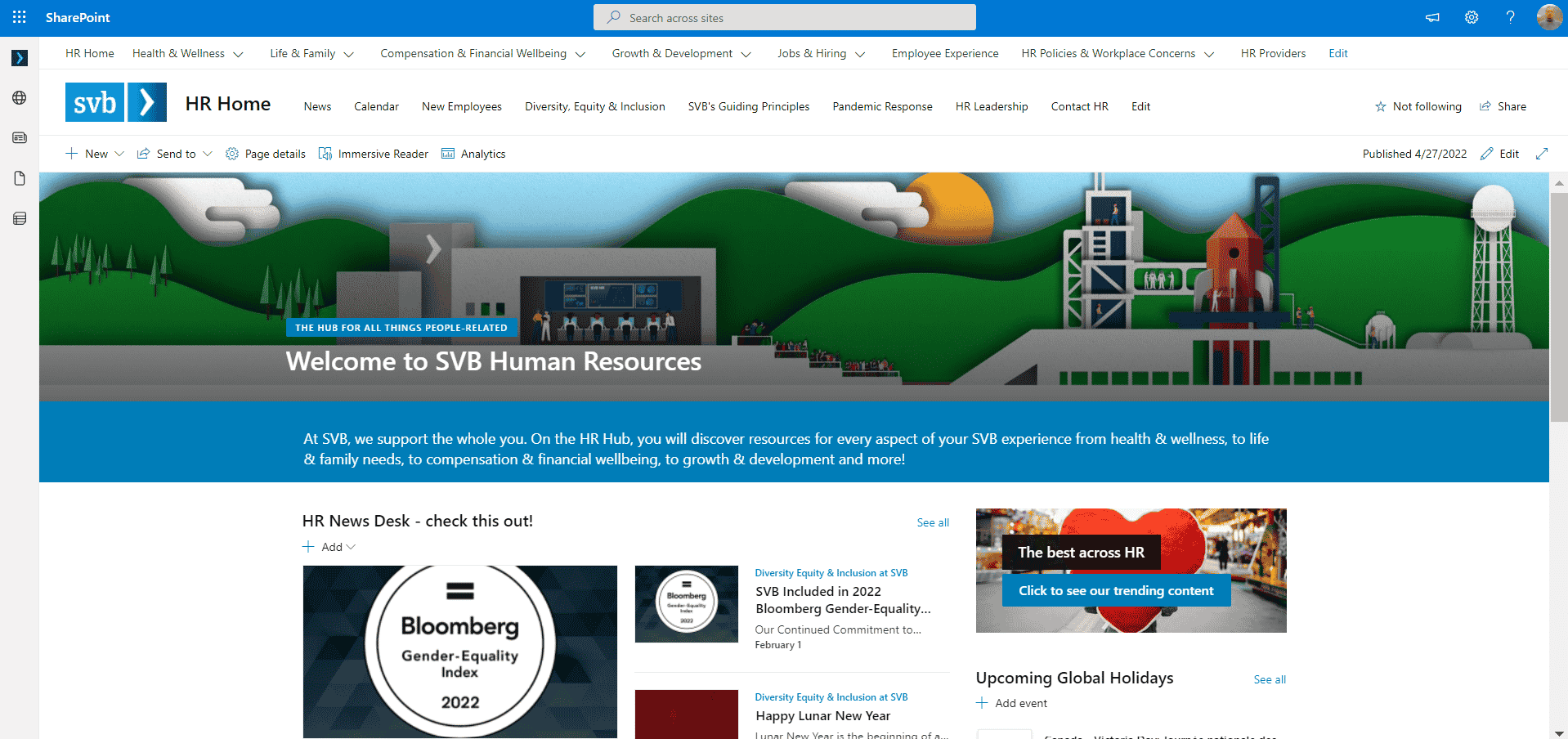

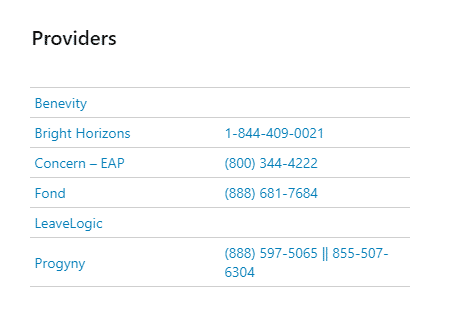

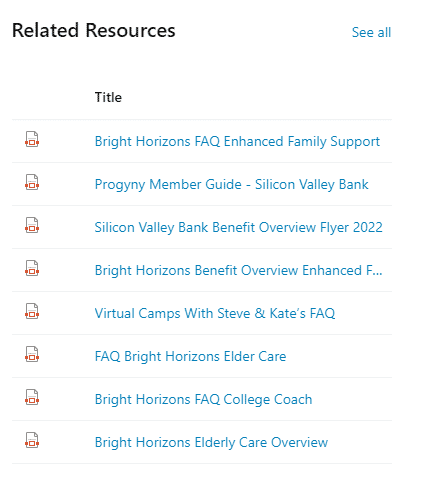

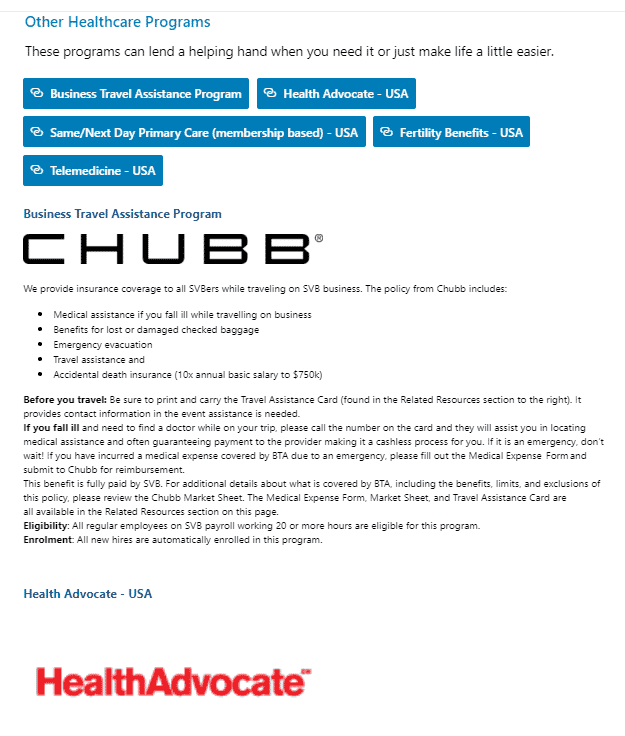

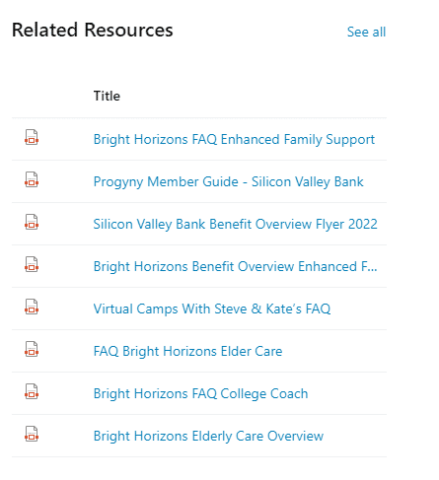

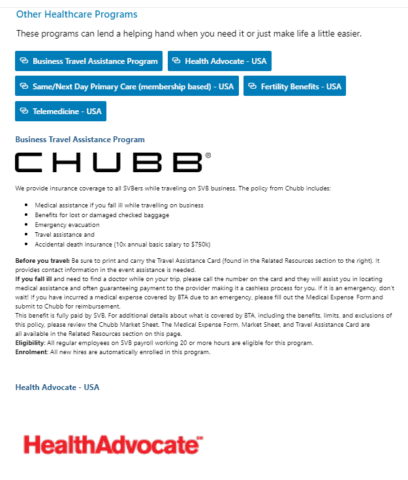

HighlightsLEARN MOREChiron partnered with Silicon Valley Bank (SVB) to successfully migrate their HR portal from SharePoint 2010 to SharePoint Online. By implementing innovative solutions such as shared navigation, audience targeting using Office 365 dynamic groups, and custom-developed web parts, Chiron enabled SVB to personalize user-specific content based on their country of origin, eliminating the need for multiple pages. The project showcased Chiron’s expertise in SharePoint migration, content management, and custom development, resulting in an enhanced user experience and improved content organization for SVB’s HR portal.

LEARN MORE -

HighlightsLEARN MORE

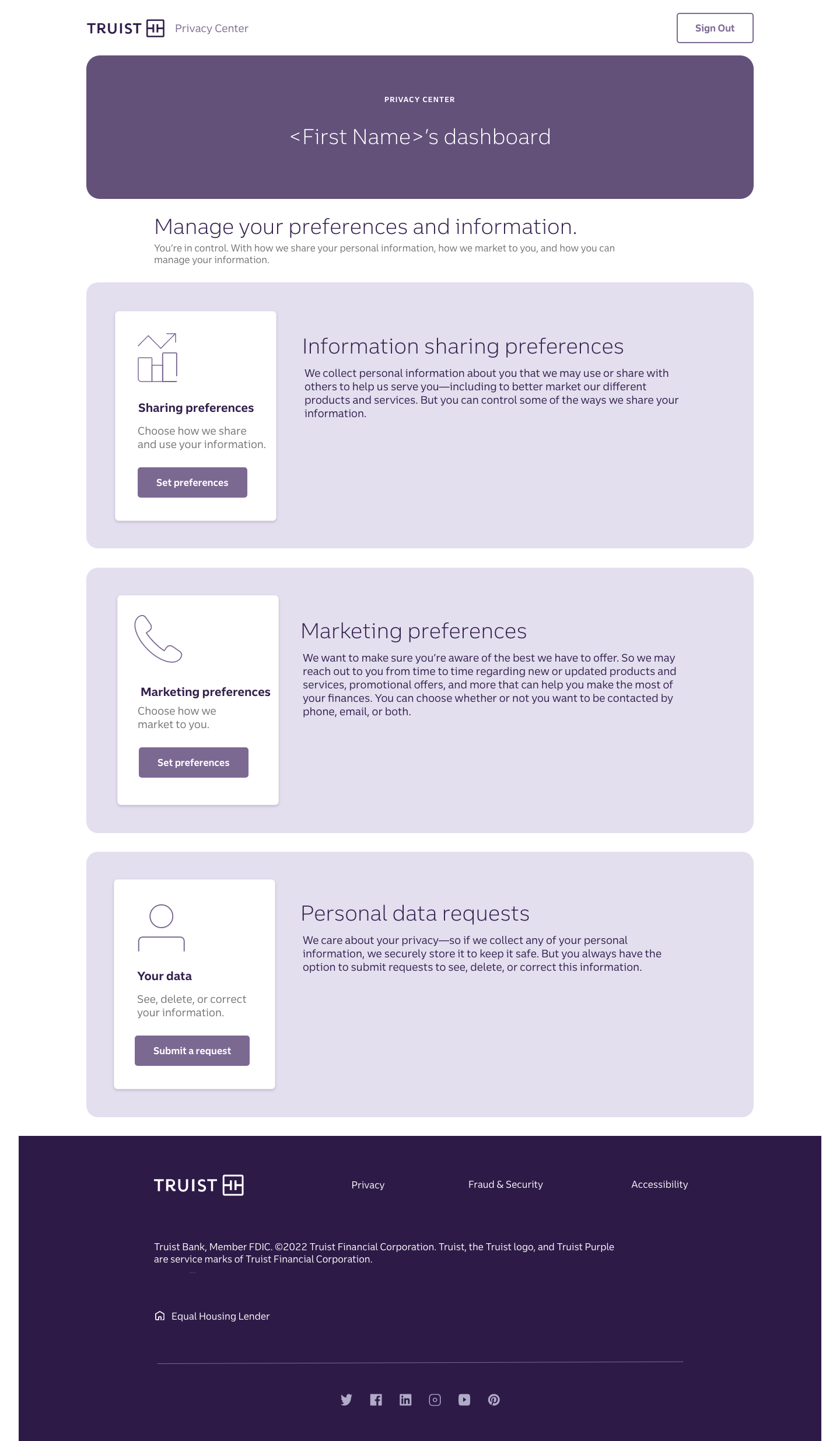

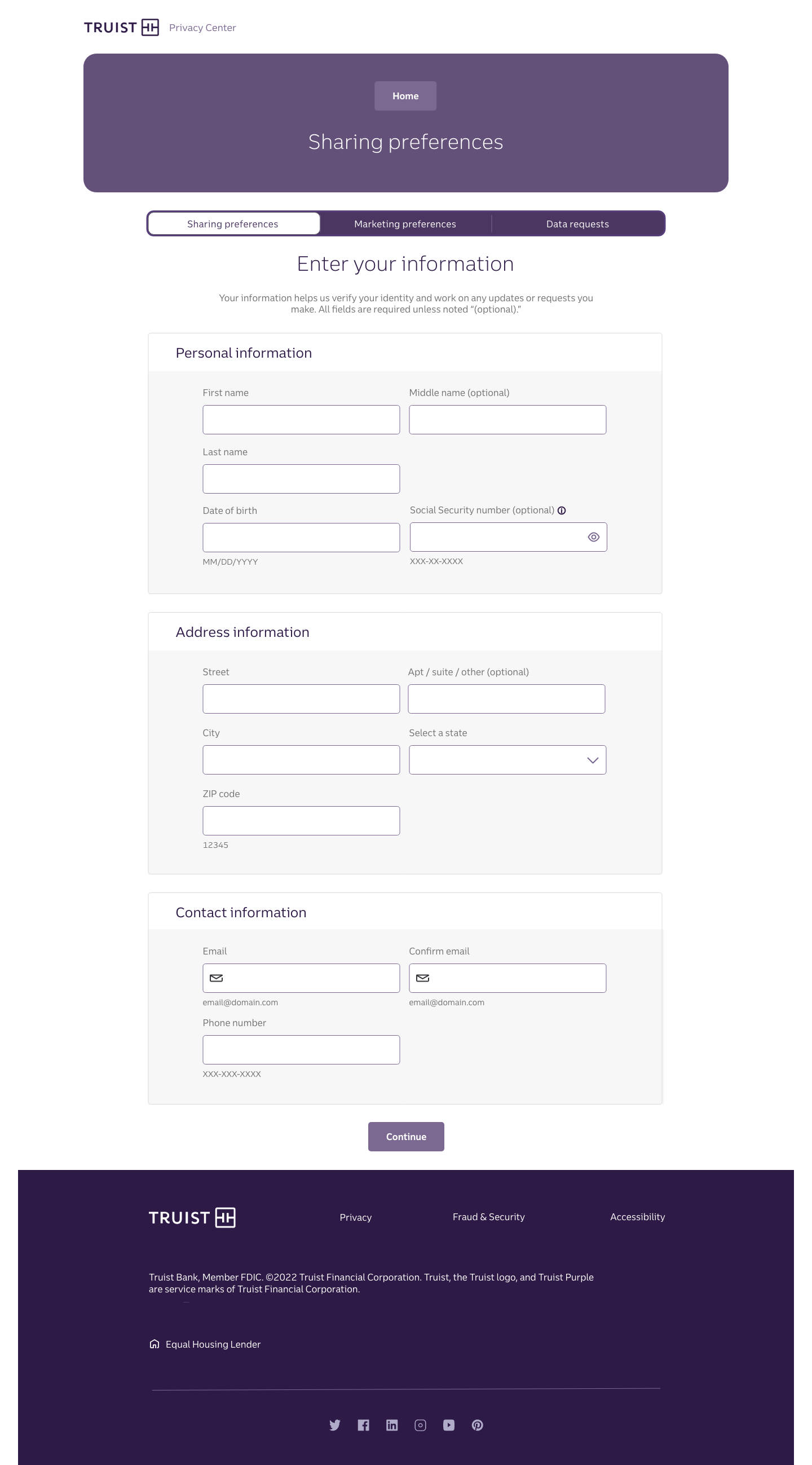

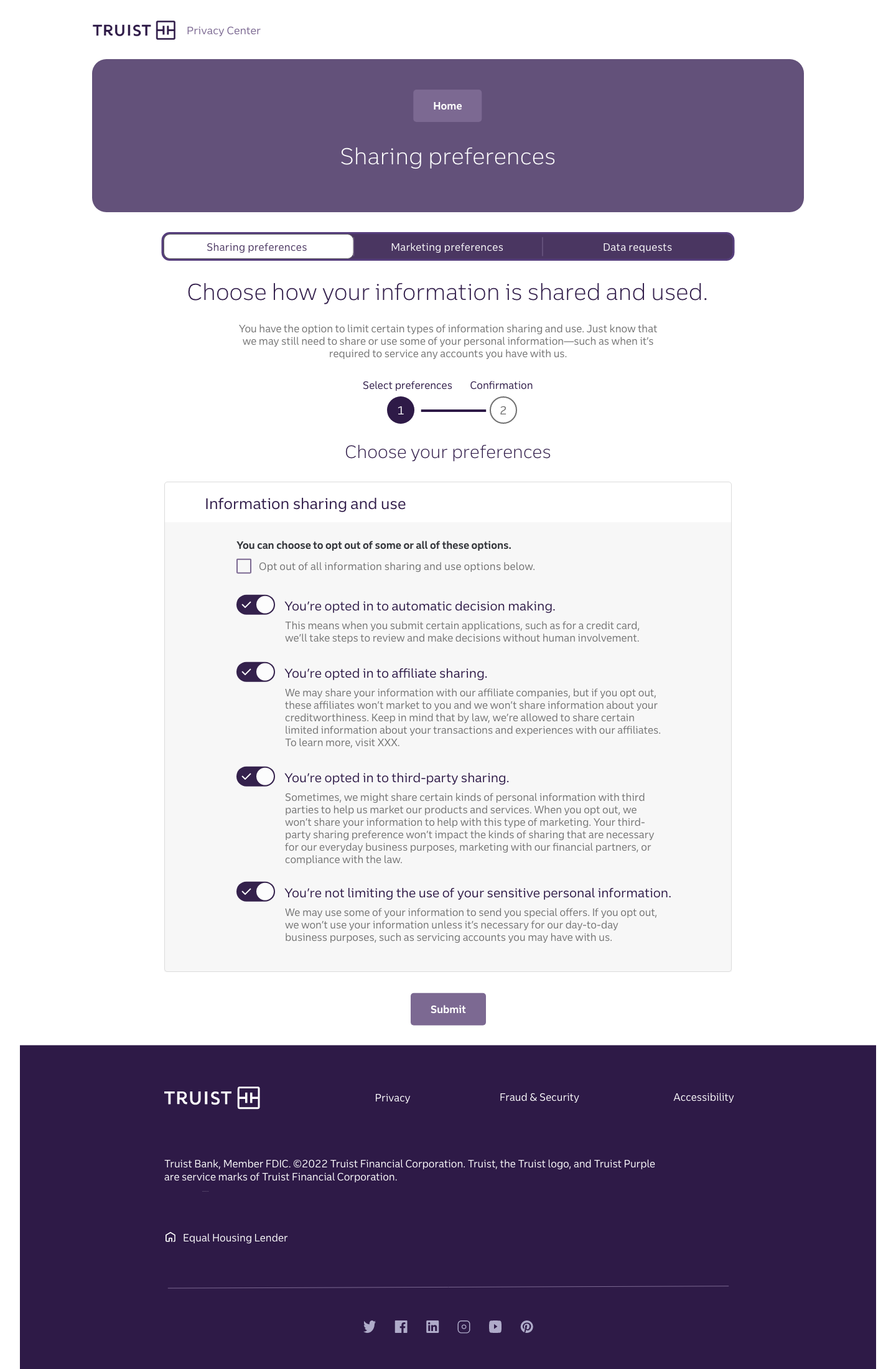

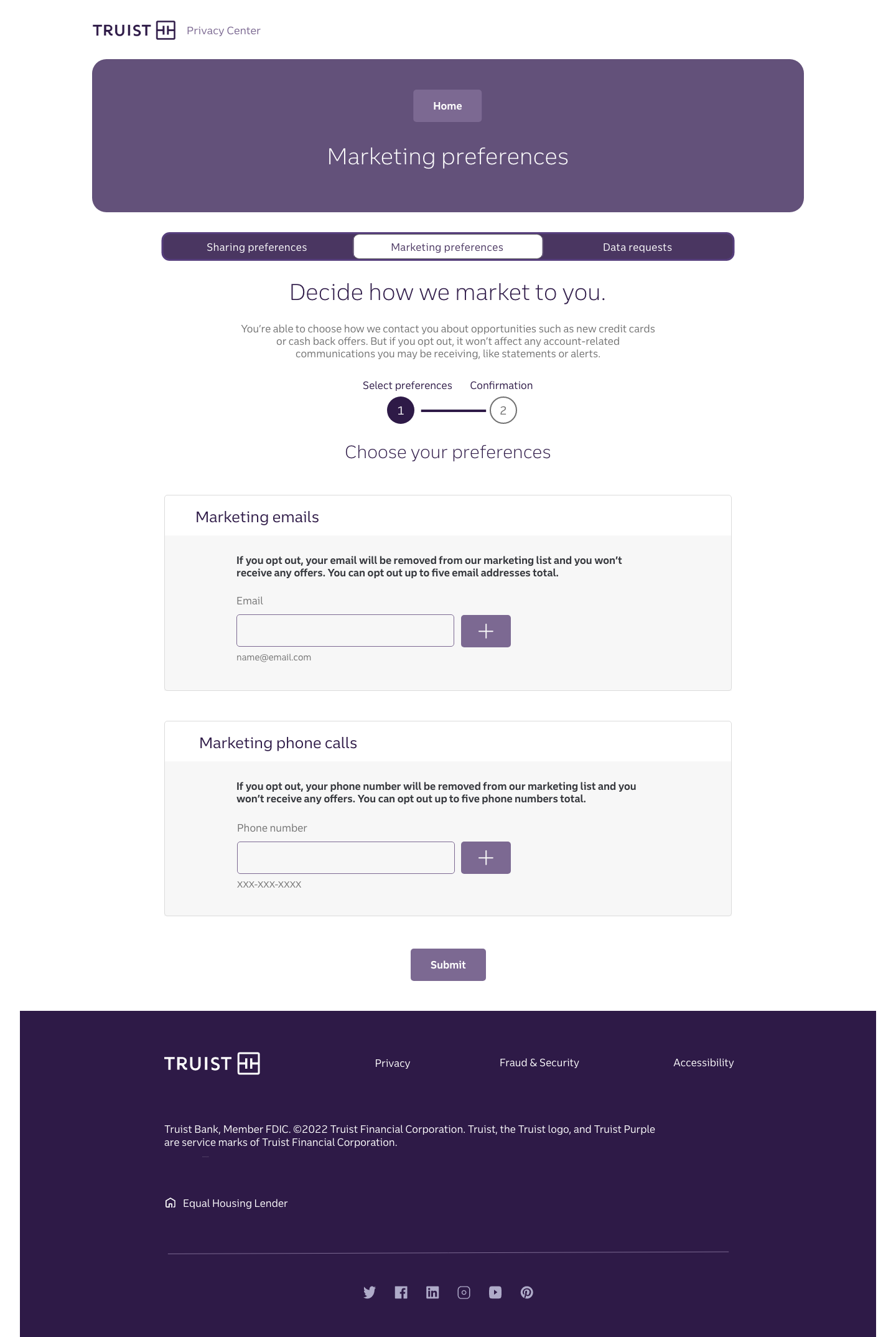

HighlightsLEARN MOREAs a key player in the project, Chiron collaborated with multiple teams, including Guardians, Awesome Awangers, and Privacy Pirates, to deliver a comprehensive solution. With a strong focus on UI and API implementation, Chiron worked closely with business users, product owners, and UI/UX experts to ensure that the Privacy and Help Center portals aligned with the specific requirements of the banking industry, enhancing the overall online banking experience.

As a result of Chiron’s efforts, Truist Bank users enjoyed a seamless online banking experience with updated modules and enhanced functionality across the web portal, mobile app, and online banking platforms. The Privacy and Help Center portals successfully integrated into the existing infrastructure, providing a user-friendly and secure environment for all customers.

LEARN MORE

Testimonial

Don’t take our word for it – here’s what our clients say:

Transforming the Financial Landscape with Cutting-Edge Technologies

In today’s rapidly evolving financial landscape, the integration of advanced technologies has become paramount for success. From managing complex transactions to ensuring regulatory compliance, the financial sector stands to gain immensely from embracing innovative IT solutions. Let’s delve into how these technologies are reshaping the financial industry and driving unprecedented growth.

1. Digital Banking Revolution: Digital banking solutions have revolutionized the way financial institutions interact with customers. Seamless mobile apps, secure online transactions, and personalized experiences are reshaping banking. Technologies like AI-powered chatbots provide real-time assistance, enhancing customer satisfaction and accessibility to financial services.

2. AI and Machine Learning for Investment Strategies: AI and machine learning algorithms are revolutionizing investment strategies. These technologies analyze massive datasets to detect market trends, assess risk, and predict asset performance. Investment professionals can make more informed decisions, optimize portfolios, and respond swiftly to market changes.

3. Blockchain and Cryptocurrencies: Blockchain technology offers enhanced security, transparency, and traceability for financial transactions. It’s particularly impactful for streamlining cross-border payments and eliminating intermediaries. Cryptocurrencies are also gaining traction, offering new avenues for asset diversification and investment.

4. Fintech Disruption: The rise of fintech startups has disrupted traditional financial services. Peer-to-peer lending, robo-advisors, and digital payment platforms are challenging conventional banking models. By adopting fintech collaborations, established institutions can tap into innovative solutions to enhance operational efficiency and customer experiences.

5. Regulatory Technology (RegTech): Ensuring compliance with a complex web of regulations is a significant challenge for financial institutions. RegTech leverages AI, data analytics, and automation to simplify compliance processes, reduce risks, and minimize potential breaches.

6. Data Analytics and Business Intelligence: Data analytics tools offer insights that drive strategic decisions. Advanced data processing helps financial institutions understand customer behavior, optimize marketing campaigns, and improve risk assessment. Business intelligence dashboards provide real-time visibility into key performance indicators, enabling timely course corrections.

7. Cybersecurity and Fraud Prevention: With the increasing digitization of financial transactions, cybersecurity has never been more critical. AI-driven cybersecurity solutions monitor networks for suspicious activities and proactively defend against cyber threats, safeguarding sensitive customer data and financial assets.

8. Robotic Process Automation (RPA): RPA streamlines repetitive, rule-based tasks, reducing errors and increasing operational efficiency. By automating routine processes, financial institutions free up human resources for more strategic initiatives and enhance customer interactions.

9. Customer Relationship Management (CRM) Enhancement: CRM systems tailored to the financial sector enable institutions to manage client relationships effectively. By tracking customer interactions, preferences, and histories, financial professionals can provide personalized services and strengthen client loyalty.

10. Enhanced Data Management and Governance: With stringent data privacy regulations, proper data management is essential. Advanced data governance solutions ensure data quality, security, and compliance, enabling financial institutions to confidently manage and leverage their data assets.

In the dynamic and competitive financial sector, embracing these cutting-edge technologies is no longer an option but a necessity. Chiron specializes in helping financial institutions harness the power of these innovations, enabling them to stay ahead in an ever-evolving industry. Through tailored solutions, expert guidance, and strategic implementation, Chiron empowers the financial sector to navigate challenges, seize opportunities, and achieve sustainable growth.